From Jamaica to Financial Independence: My Journey and the Money Lessons I Had to Learn the Hard Way

In 1983, my eldest brother, one of the first set of male nurses trained in Jamaica, invited me to Kingston, the capital city, and took me to an interview at Kingston School of Nursing.

I was 17 years old. An avid reader. A dreamer.

He told me plainly, “This is your ticket out of Jamaica.”

And deep in my young heart, I knew he was right. I loved my country, but I also knew Jamaica could not fulfill the dreams I carried inside me. I wanted more - not just financially, but in opportunity, growth, and impact.

I got in.

That moment set me on my professional path. But it would take more than three decades for me to truly understand my financial one.

A Nursing Career Began… But Financial Education Did Not

By 1986, I completed nursing school and began working at a local hospital. Over the next few years, I studied and trained to pass special exams so I could become eligible for U.S. recruitment.

In 1987, I had my first daughter.

In 1990, I landed at JFK Airport just days before my 24th birthday, recruited to work at Kings County Hospital in Brooklyn. It was the most fantastic moment of my life.

I was officially living the American dream.

But no one had taught me how money works.

I was trained to save lives - not to build wealth.

Introduced to Financial Tools… Without Financial Understanding

In 1992, after the birth of my second daughter, I was introduced to life insurance. I purchased a term policy from a Primerica agent in NYC, but I did not invest. No one around me was talking about investing. No one talked about passive income, compounding, or building assets.

They talked about:

Student loans

Tax refunds

Social Security

“The government will take care of us.”

I also participated for years in something common in Jamaica called SuSu - a group savings pot where each person takes turns receiving the lump sum. While SuSu builds discipline, it does not build wealth. There is no growth. No compounding. No time value of money.

Had I invested just $100 per month back then, the power of compound interest could have transformed my financial future.

Instead, I missed decades of growth.

And that is the high cost of waiting.

Income Without Direction Is a Dangerous Thing

By 1996, I had my third daughter. I was making good money as a visiting nurse. But without guidance, I was doing what many hardworking people do:

Working.

Spending.

Giving.

Helping family.

Saving little.

Investing nothing.

I truly believed Social Security would take care of me. After all, this was America - not Jamaica.

But income without a plan creates the illusion of security, not real security.

I had no concept of:

Paying myself first

Setting a debt freedom date

Building passive income

Or understanding how money could work harder than I did

Survival Mode Years

In 2002, my marriage fell apart, and I moved to Miramar, Florida, with my three girls. I worked two jobs for many years to provide for them and to give them a comparable lifestyle to the one I had pulled them away from in New York.

In 2007, friends introduced me to Dave Ramsey’s Financial Peace University. I implemented some of the teachings, but I didn’t follow through fully.

The one thing I stayed faithful to was term life insurance.

Even without wealth, protection mattered.

That decision gave me peace of mind knowing my daughters would not be destitute if something happened to me. That principle aligns with what I now teach as the theory of decreasing responsibility—as your assets grow, your need for insurance decreases, but in the early years, protection is critical. You need a plan that empowers you to live with purpose, peace, and prosperity, clarity, confidence, and control.

My Financial Wake-Up Call

By 2016, I was exhausted. Still working. Still serving. Still pouring into others.

And quietly, teetering on the edge of financial disaster.

My daughters were grown. I was alone. And I realized I had lost my way.

That season brought me to the lowest point of my life.

My credit score had fallen to 490.

But I still had my faith. And I had something else - I had years of personal development books that had trained my mind to endure.

In October 2016, I moved to Lakeland, Florida. By 2017, I made a decision to rebuild.

And that’s when personal finance education transformed my life.

I learned about:

Paying yourself first

The rule of 72 (how long it takes money to double)

Dollar-cost averaging

The power of compound interest

The importance of having a clear financial plan

As I applied these principles, my finances changed.

And as my finances changed, so did my confidence, clarity, and calling.

From Nurse to Money Nurse

In 2019, I became a certified Dave Ramsey financial coach. In 2020, I returned to school to complete my doctorate in nursing. I was working in the ER, climbing the ladder, pushing forward.

That same year, my husband had open-heart surgery. In 2022, he began home dialysis.

In October 2023, I graduated with my doctorate.

But by November, something shifted.

I knew corporate advancement was not my assignment.

Education was.

Impact was.

So I dusted off my financial coaching hat.

In January 2024, I made a big leap of faith into the financial industry. The language and acronyms were foreign to me - but I’m a nurse, I can do whatever I set my mind to do.

I passed seven financial exams in 17 months.

And in November 2025, I stepped away from nursing to become The Money Nurse full-time.

Today, I help individuals and families:

Earn money

Save money

Eliminate debt

Invest for retirement

My specialty is educating nurses and middle-income families on how money works so they can build assets, create passive income, protect their households, and design a clear path toward financial independence, give generously, and leave a lasting legacy.

From Nurse to Money Nurse

Here are some of the concepts that changed everything for me:

1. Pay Yourself First

If you don’t prioritize your future, your present will consume everything.

2. The Power of Compound Interest

Money grows faster than people realize—but only if you give it time.

3. The Rule of 72

This shows how quickly money can double—or how quickly debt can destroy.

4. Dollar-Cost Averaging

Consistency beats perfection.

5. The High Cost of Waiting

Time is either your greatest ally or your greatest regret.

6. The Theory of Decreasing Responsibility

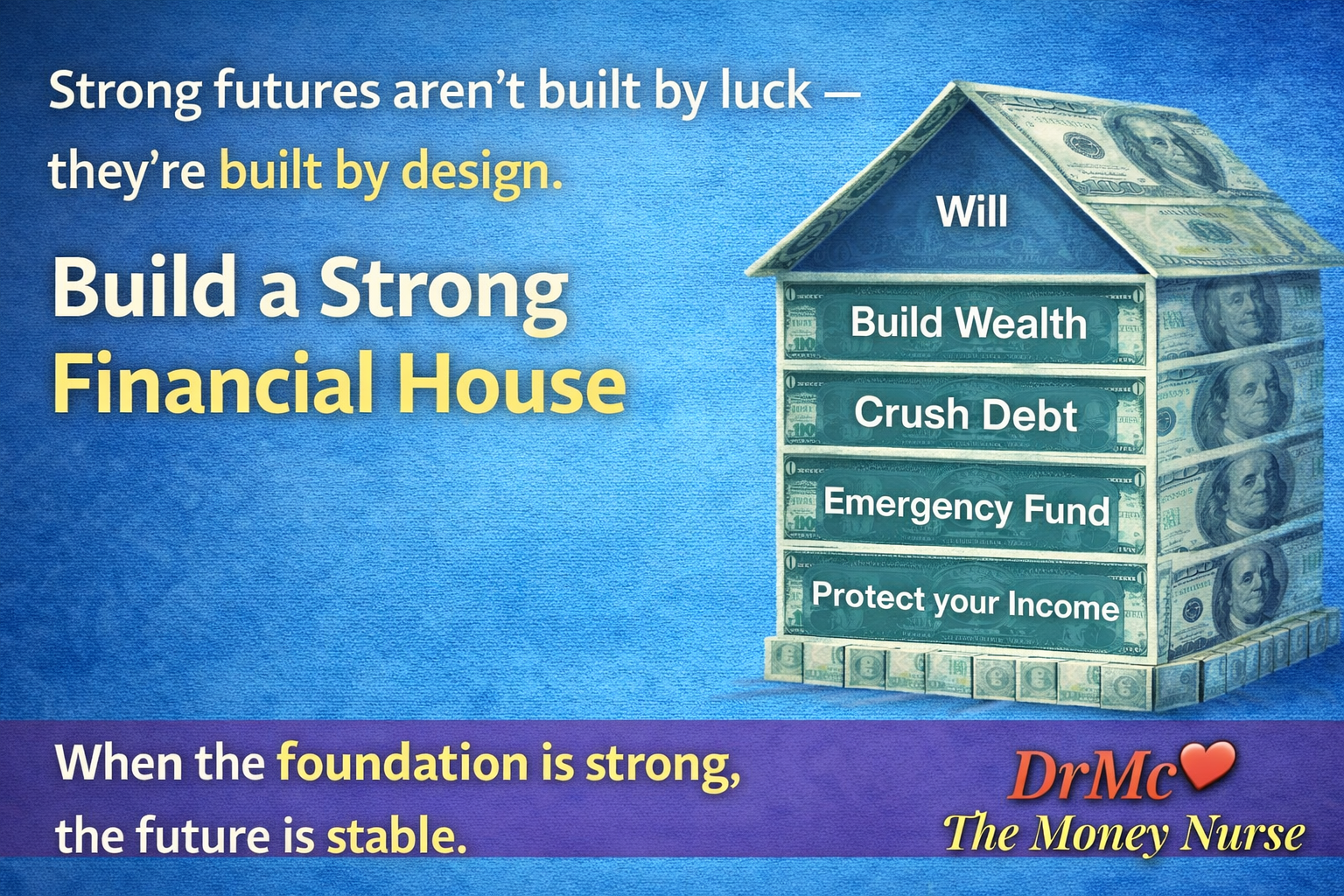

Protection first. Wealth building next. Legacy last.

7. A Debt Freedom Date

Hope is not a plan. A timeline is.

Closing Reflection

You now know my story.

I don’t share it for sympathy.

I share it to spark awareness.

The Focus of my Practice

The focus of my practice is building wealth and rewriting legacies.

We educate individuals and families on how money works: how to earn money, save money, get out of debt, and invest for retirement. How to break the paycheck-to-paycheck cycle, build assets, create passive income, and achieve lasting financial independence.

My work is rooted in empowering healthcare professionals and families to grow with confidence, give generously, and leave a legacy that creates impact for generations.

So let me ask you:

Are you on the right financial path?

Do you have the right mindset when it comes to money?

How often do you actually think about your financial future?

When you think about money, what emotions come up?

What percentage of your income is passive?

If you have children, would you want their lives to be the same, better, or worse if you were gone?

How much monthly income would your family need if you weren’t here?

On a scale of 1–10, how satisfied are you with your current financial plan?

Who is helping you invest and plan for retirement?

Who is helping you build a strong financial house?

If you need help navigating these questions, don’t hesitate to reach out.

_______________________________________________

Hi, I’m Althea! I used to work as an RN, now I’m The Money Nurse - equipping professionals with tools to earn money, save money, get out of debt, and invest for retirement. Empowering them to break the paycheck-to-paycheck cycle, gather assets, build passive income, and create a clear path to financial independence.

Still a nurse. Still impacting lives. Just Differently.

🆓 Want free tools and insights?

Let’s connect. ❌ No Cost ❌ No Obligation

📅 Schedule your FREE financial chat today:

👉🏽 http://altheamcleish.com/linktree

I can’t wait to connect with you and help you start your journey to lasting financial independence!

DrMc💜, TheMoneyNurse

#RNadvisorcoach #Financiallyfit #Clarity #Confidence #Control #MoneyMatters #LagacyMultipliers #Empowerment #MedicinetoMoney #ScrubstoStrategies